Using a credit card may seem like a convenient solution to cover expenses until the next paycheck arrives. However, relying on credit cards as a long term strategy to manage your finances could lead to mounting debt, especially when you don’t understand how credit card interest works. For instance, you may have nabbed a credit card with a high number of interest free days. But you may be struggling to understand when the interest-free days actually start and whether they apply to each new purchase you make.

If that sounds familiar, you’re not alone. Understanding how credit card interest works can be slightly confusing at first. Let’s dive into interest free periods and how credit card interest is calculated so you could learn how to use your card responsibly and potentially avoid interest with ease.

Understanding the interest-free period on your credit card

Interest-free period on a credit card refers to the period between the time of making a purchase and the time interest is charged on that purchase. This time duration could vary depending on your credit card, and may extend to 15-25 days after the end of your statement cycle.

If your card offers, for example, an interest-free period of 15 days after the end of your billing cycle, you’ll get 45 interest-free days if you make a purchase on the day your billing cycle begins. It does not mean that every time you make a purchase, you have 44 days from the time of the purchase before you begin to accrue interest on it. Your interest calculation isn’t based on when you use your card to make a purchase. It’s based around your statement period and total outstanding credit card balance.

Your statement period may begin at the first of the month, or the day you were approved for your credit card. This will be available on your credit card statement.

So, if your credit card statement period begins on the 1st of the month, and you make a purchase on the first day of your statement period, you will not be charged interest on that purchase for however many interest free days you have on offer. I.e. that purchase will begin accruing interest 44 days after the 1st of that month.

How your billing cycle works

Confused? It may be worth taking a moment to better understand your credit card billing cycle before we continue.

How Credit Cards Work: Billing Cycle and "Grace Period"

How does an interest free period work?

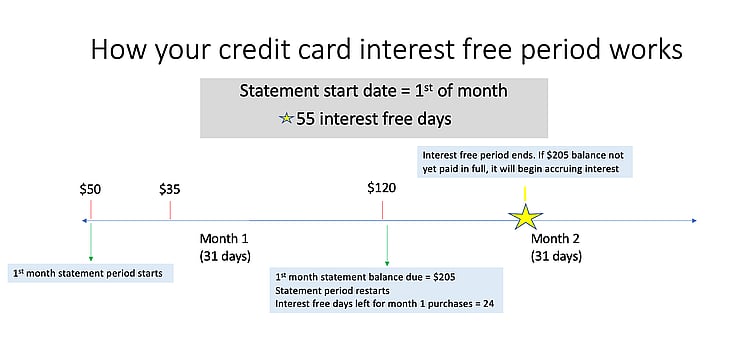

Your interest free period is the number of interest free days on offer with your credit card. For example, 55 days interest free.

Your interest free period works as per the following:

- Your statement period begins – either first of the month or the date your card application was approved.

- Your interest free period begins from this same date.

- You make a purchase on the first day of your statement period. Interest will begin accruing on this purchase at the end of the interest free period, e.g. you have 55 days to pay off your card balance before you’re hit with interest.

- You make another purchase seven days later. You now have 48 days (55 interest free days minus seven calendar days) to pay off your balance before you begin accruing interest.

- You make a purchase the day before your statement period ends, e.g. the 31st of the month. You only have 25 days (55 interest free days minus 30 calendar days) to pay off this purchase.

Ideally, you would have waited one extra day to make the last purchase and your interest rate period would have reset, as your statement period would have begun again.

Here is a helpful breakdown of your billing cycle and how the interest free period fits into two calendar months.

How does credit card interest work?

Credit card interest refers to the cost of borrowing money from a credit card issuer. When you make a purchase on your credit card and don’t pay it off in full by the due date, your credit card account starts accumulating interest on the outstanding balance. In other words, if you pay off your credit card bill in full each month, you won’t pay any interest on your spending. Some credit cards also offer an interest-free period, typically between 44 to 55 days, during which no interest is charged on purchases made within the statement period. But once the interest-free days expire, the credit card issuer will typically apply the daily rate to your outstanding balance to determine the interest charged.

The interest rate on your credit card is usually expressed as an Annual Percentage Rate (APR). This is the amount of interest that you will pay on your credit card balance over the course of a year. However, the interest you’re charged on your outstanding balance in each billing cycle is not directly calculated using the Annual Percentage Rate. This APR is typically divided by 365 to get the daily rate that is applied to your credit card account balance.

For example, a card with an APR of 17 per cent would have a daily rate of 0.00046. So, if you have an outstanding balance of $1,000 on the card, you will be charged $0.46 in daily interest. This adds up to around $13 in a month. While this may not seem like a lot, you need to understand that the interest on your credit card gets added to your outstanding balance each month, increasing it over time.

If you only make the minimum repayment each month, you’re only paying a small percentage of the outstanding balance. The remaining balance on your card, as well as the interest charges, get carried forward to the next billing cycle.

If you continue spending on the card, and only pay the minimum amount due each month, your total outstanding is likely to grow over time, putting you at risk of falling into a debt spiral. It’s usually advisable to try and pay off your card balance in full every billing cycle, or at least pay more than the minimum repayment amount, to avoid accumulating debt.

How to never pay interest on your credit card

Interest free days are a handy way for cardholders to try and limit the amount of interest they’re charged.

If you’re able to pay your statement balance in full each cycle before the end of your interest free period, you’ll potentially never pay interest on your credit card. Being aware of how your credit card works may be invaluable in helping you avoid falling into debt and stay on top of your bills.

As mentioned earlier, some credit cards do not offer any interest free days, and any purchase you make will begin accruing interest immediately. Further, if you have a balance transfer credit card and make any new purchases with said card, those new purchases will immediately begin accruing interest.

This is why it’s crucial you not only do your research around the number of interest free days offered by your card provider as well as the purchase rate, but also ensure you’re using your credit card intelligently.

If you are paying off a balance transfer, you may want to lock your balance transfer card in a drawer or chuck it in the freezer so you’re not tempted to make any new purchases, which will immediately be hit with interest.

It’s also important to note that even if you keep credit card interest to a minimum you may be stung by ongoing fees, such as annual fees and foreign transaction fees. Don’t forget to look at the potential fees on offer that may

How to find credit cards with the highest number of interest free days

Comparison tables allow you to compare credit card options with ease, with the ability to filter your results based on the maximum number of interest free days.

By utilising comparison tables to your advantage, you may be able to find some competitive high interest free day offers, paired with low interest rates and low fees. Keep an eye out for any ongoing fees as well that may up the cost of your credit card.

To help you with your comparison, here are some lower rate credit cards with, higher interest-free days from the RateCity database:

| Credit Card | Number of interest-free days |

| humm 90 Platinum Mastercard | 110 |

| People's Choice Visa Credit Card | 62 |

| Defence Bank Foundation Visa Card | 55 |

| American Express Low Rate Credit Card | 55 |

| Community First Credit Union Low Rate Credit Card | 55 |

Source:RateCity.com.au. Data accurate as of 20.04.2023