Australia’s total credit card debt has dropped for the third month in a row, this time by $88.1 million.

This month’s drop is likely to be, at least in part, the result of people using money back from tax returns to clear their credit cards.

The RBA credit card statistics for August, released today, also show the value of credit card transactions dropped this month, despite an increase in accounts, in another encouraging sign Australians aren’t turning to their credit cards to cope with the rising cost of living.

This is despite the fact the number of credit card accounts rose by almost 16,000 from the previous month, and over 188,000 from the same time a year ago.

Credit card statistics: personal credit in August 2023

Note: commercial cards are excluded

| Amount | Monthly change | Year-on-year change | |

| Debt accruing interest | $17.48 billion | -$88.1 million | +$535 million |

| -0.5% | +3.16% | ||

| Number of accounts | 12.61 million | +15,961 | +188,081 |

| +0.13% | +1.51% |

Source: RBA, released 9 October 2023, original data, excludes commercial cards. Monthly change is July to August 2023, year-on-year change is August 2022 to August 2023.

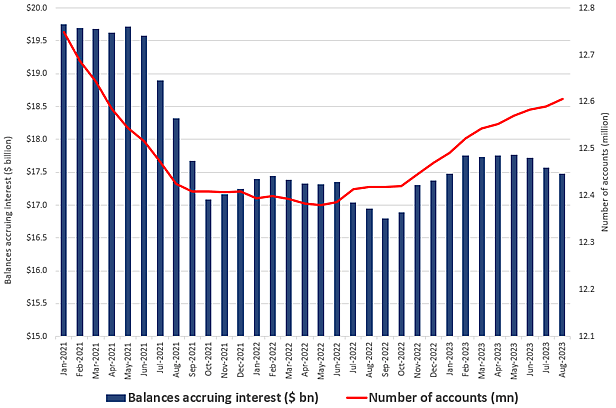

Balances accruing interest vs number of accounts

Source: RBA

Total value of transactions: personal credit and debit cards in August 2023

| Amount | Monthly change | Year-on-year change | |

| Value of debit card transactions (personal cards only) | $48.25 billion | +$518 million | +$2.87 billion |

| +1.09% | +6.32% | ||

| Value of credit card transactions | $26.67 billion | -$146 million | +$1.31 billion |

| -0.54% | +5.16% | ||

| Total | $74.92 billion | +$372 million | +4.18 billion |

| +0.50% | +5.9% |

Source: RBA, released 9 October 2023, seasonally adjusted data, excludes commercial cards. Monthly change is July 2023 to August 2023, year-on-year change is August 2022 to August 2023.

RateCity.com.au research director, Sally Tindall, said: “It’s brilliant to see Australians focused on clearing credit card debt. Some people are likely to be taking advantage of money back from their tax to help wipe the slate clean.”

“It is also encouraging to see the number of credit card transactions have dropped in August, despite the fact the number of credit cards is on the rise,” she said.

“Many families are feeling the pinch of the rising cost of living and 12 RBA hikes, but are resisting the temptation to reach for the credit card.

“However, these totals don’t tell the whole story. Some households have undoubtedly used their credit card to plug a hole in their monthly budget. If that’s you, put a priority on paying it back the very next month so the hole doesn’t become a sinkhole.

“If you have credit card debt, take the time to work out how you’re going to pay it off in full. The bank will give you a minimum repayment amount – make sure you ignore this and pay as much of your debt as you can, if not all,” she said.